Companies that buy inventory from a supplier are often allowed to pay the debt at a later date. In this case, the business is purchasing something on credit from the merchant, who essentially becomes a lender. If you are looking at both systems in a real-life scenario, consider a business that pays salaried employees on the first day of the following month. You settle the payment at the end of the...

AAF has been one of the top accounting firms in Boston since 1973, founded by entrepreneur Herbert Alexander. Today, AAF is made up of a team of more than 170 financial professionals located in three Massachusetts offices. We consult with small and midsized accounting firms on complex U.S. and international tax issues. Thought Leadership is developing and implementing creative strategies to build ...

That’ll be especially helpful when tax time rolls around and you need to categorize your write-offs. I get a QuickBooks error when I open a company file from the Qbox Explorer. Be careful when using Remote Access abroad, as it can eat away at your data plan. Again, there is a lot of data traffic going on here, so this feature is best used with a solid, fast Wi-Fi connection. Yes, this is a pretty ...

But with 12 months of accurate books, your finances are accurate and ready to file taxes at year end. Today’s leading accounting platforms offer standard security features such as data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe...

Content Tips for Recording Payroll Accrual What impact will the acquisition have on your company? Payroll Analytics Benefits of Using Accrued Payroll Calculate your employee’s wages It is simpler than the accrual method but shows a lagging, incomplete picture of the company’s financial standing. Keeping track of payroll entries, credits, and debits for every employee in your organization as well a...

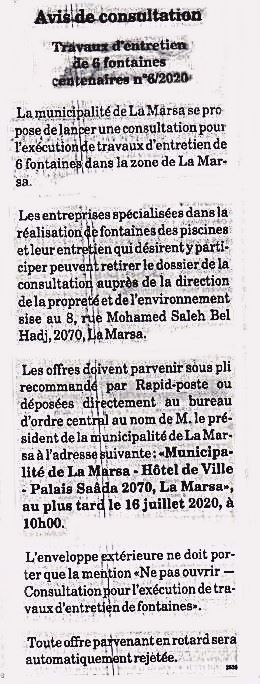

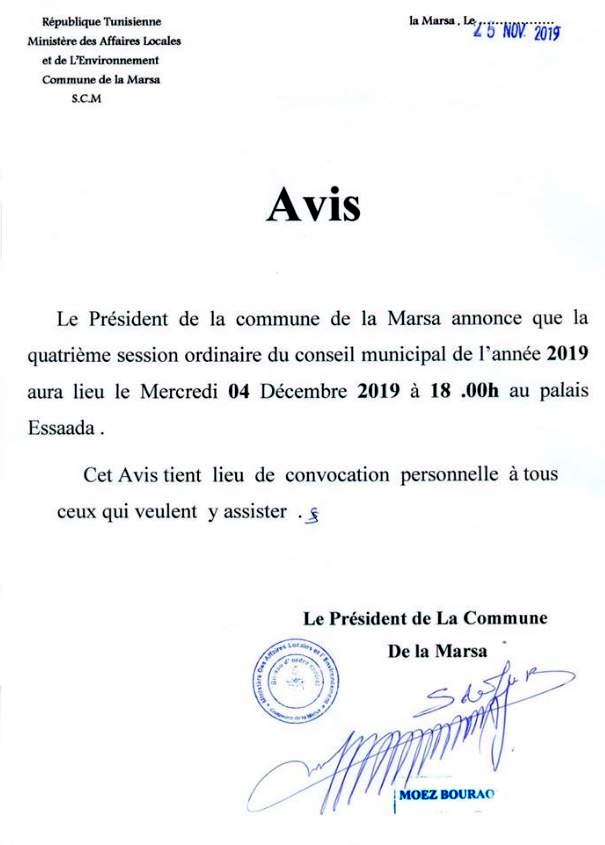

Français

Français العربية

العربية